The income tax exemption is effective from January 1 2022 until December 31 2026. Paragraph 28 Schedule 6 Income Tax Act 1967 provides that the income derived from sources outside Malaysia is exempt from tax.

The IRB is ready to accept any disclosuredeclaration made by taxpayers without carrying out a tax audit or investigation.

. If you earn money abroad it is not taxable. The tax exemption is effective from Jan 1 2022 to Dec 31 2026. An individual whose employment period in Malaysia exceeds 60 days would be taxable unless they are able to seek exemption from Malaysian tax under the dependent personal services article of the relevant double tax treaty.

MIRB announced that if individuals who are working overseas have returned to Malaysia temporarily and are working remotely from. All types of income received by individual taxpayers. PENJELASAN BERKENAAN E-MEL PROGRAM KHAS PENGAKUAN SUKARELA.

Dividends received by companies and limited liability partnerships. Malaysia currently only charges income tax on Income derived from Malaysia but expect this to change in future budgets. A non-resident individual who exercises employment in Malaysia for not more than 60 days is exempt from Malaysian tax.

Remittances of foreign-source income into Malaysia by Malaysian tax residents are exempted from income tax. However Section 27 of the Finance Act 2021 amended paragraph 28 of Schedule 6 to read as follows. The voluntary disclosure programme is only for those who have secretly channelled Malaysian income overseas.

This exempts income that comes from overseas like rental of property or freelance work and also remote working employees of companies that are not based in the country. Inland Revenue Board of Malaysia Non Resident Branch 3rd Floor 6 8 Blok 8 Kompleks Bangunan KerajaaJalan Duta 50600 Kuala Lumpur. Malaysia adopts a territorial principle of taxation in that only income accruing in or derived from or received in Malaysia from outside Malaysia is subject to income tax in Malaysia pursuant to Section 3 of the Income Tax Act 1967 ITA.

Tax on foreign-source income remittance November 18 2021 A provision in the Finance Bill would tax foreign-source income received by any Malaysian resident person effective from 1 January 2022. Under the Finance Bill FSI received in Malaysia between Jan. Have income that is liable to tax.

In the most recent budget which was announced in October 2021 it was stated that from January 2022 the treatment of foreign sourced income would be changing. 1 2022 until June 30 2022 by all tax residents including individuals and companies will be taxed at 3 on a gross basis. Prior to December 31 2021 paragraph 28 of Schedule 6 provided that foreign source income received in Malaysia by an individual or company carrying out business other than banking insurance or sea or air transport is exempt from income tax.

The employment income derived from Malaysia would be subject to Malaysian tax unless it can be exempted under the 60 days rule or pursuant to a tax treaty. KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the tax initiative said the Ministry of Finance MoF. Register your income tax file.

The tax would be imposed at a transitional tax rate of 3 based on the gross amount received from 1 January 2022 through 30 June 2022. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. You should register an income tax file with the Inland Revenue Board if you.

If you are from one of these countries then you are exempt from paying income tax to the Malaysian government. The Finance Bill 2021 has been passed with some amendments and the MOF has issued a media release dated 30 December 2021 on the amendments and subsequently the. The categories of foreign-sourced income that are exempt from income tax are the following.

The Inland Revenue Board IRB has issued a media release to introduce a Special Programme for Foreign Income Remittance PKKP. References for Income Tax Act 1967 Section 3 Income Tax Act 1967 ITA says that income shall be charged for the income of any person accruing in or derived from Malaysia or received in or from Malaysia. It is proposed in Budget 2022 on 29 October 2021 that the foreign-sourced income of Malaysian tax residents which is received in Malaysia be taxed - effective from 1 January 2022.

For years some foreign sourced income had fallen under tax exemption in Malaysia effectively reducing the taxable income of some Malaysian citizens working abroad and sending money. A transitional tax rate of 3 is accorded on the gross amount remitted from 1 January 2022 to 30 June 2022. Sayantan Sengupta In CA Final Author has 117 answers and 1114K answer views 4 y Related.

The Chartered Tax Institute of Malaysia. Tax Concession for Income Paid by Overseas Employers. The tax rate on FSI received after this period will be the prevailing tax rates for resident individuals and companies.

Since 2004 to date income received in Malaysia from outside Malaysia or foreign-sourced income FSI received by Malaysian taxpayers is not taxable due to the availability of tax exemption under Paragraph 28 Schedule 6 of the ITA Para 28. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Malaysia has adopted a territory basis for taxation where only income derived from Malaysia is taxable in Malaysia except for the business of banking insurance and sea or air transportation.

Finally only income that has its source in Malaysia is taxable. The proposal as it stands covers all forms of income for example. With effect from the year of assessment YA 2004 tax exemption is given on income received in Malaysia from outside.

Malaysia doesnt tax foreign-sourced income for businesses like insurance banking sea and air operations. Deductions from taxable income Generally the deductions against employment income are professional subscriptions and specific travels and entertainment incurred for the employers business.

Individual Income Tax In Malaysia For Expatriates

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Latest Jobs In Pakistan In Heavy Mechanical Complex Job Vacancy In 2022 Latest Jobs In Pakistan Jobs In Pakistan Pakistan

Foreign Source Income Budget In Malaysia 2022 Wise Formerly Transferwise

Tax Implications For Malaysians With Foreign Bank Accounts And Foreign Source Income In Overseas Cheng Co Group

Foreign Income Tax Malaysia Removal Of Exemptions

Malaysia Special Tax Concessions For Individuals Kpmg Global

Living The Good Life Abroad The 22 Best Places To Retire

Malaysia Issues Tax Exemption For Foreign Sourced Income

Foreign Source Income Budget In Malaysia 2022 Wise Formerly Transferwise

Wholesale Retail Trade Wrt License In Malaysia

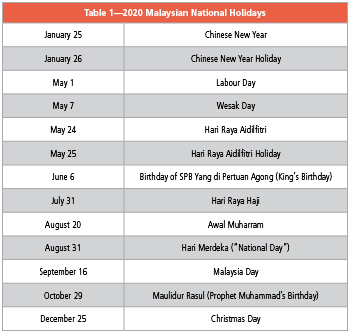

What You Need To Know About Payroll In Malaysia

What Can The Malays Do To Stop The Malaysian Chinese From Leaving Malaysia For Singapore Quora

Tax Considerations For Foreign Entities With Or Without Physical Presence In Malaysia Donovan Ho